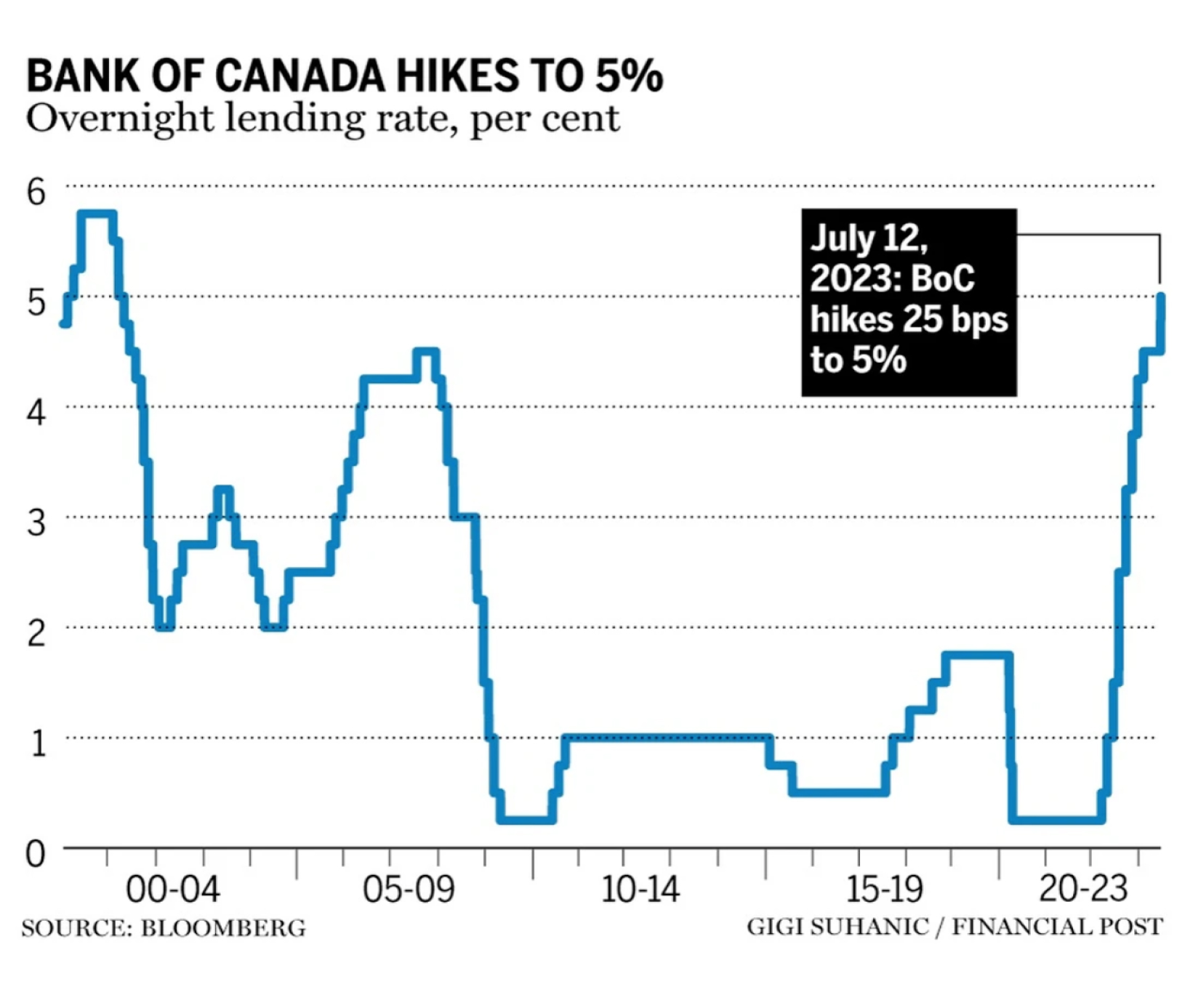

On Wednesday, the Bank of Canada decided to raise its benchmark interest rate by 25 basis points to reach 5%. In doing so, it acknowledged the possibility that controlling inflation might require a longer timeframe than initially anticipated.

While reiterating its commitment to maintaining price stability, the bank did not provide any hints regarding the future trajectory of interest rates.

During a press conference, Tiff Macklem, the governor of the Bank of Canada, mentioned that this rate hike might not be the final one. He expressed the bank’s willingness to increase the policy rate further if new information suggests it is necessary. However, he emphasized their intention to avoid excessive tightening of monetary policy.

The next announcement regarding interest rates is scheduled for September 6th.

To explore options to improve your cash flow, click here.