At Mortgage Winners, we’re excited to share how our Manulife One service helped a recent client significantly improve their financial situation. Manulife One is an innovative all-in-one mortgage and banking product that combines a mortgage with everyday banking, allowing clients to simplify their finances and potentially save on interest costs.

In a recent case study, we assisted a client with the following financial situation:

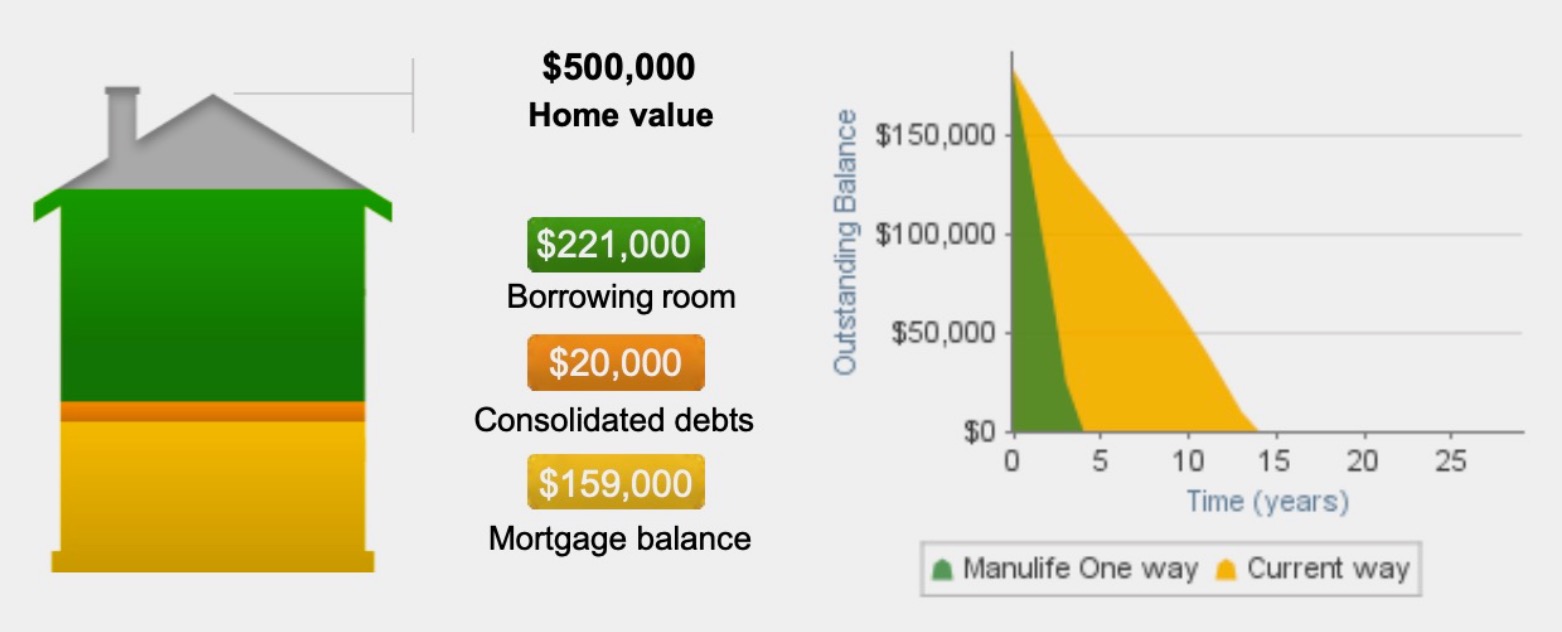

- Home value: $500,000

- Existing mortgage balance: $163,000 at 4.87% interest

- Personal loan: $20,000 at 3.25% interest

- Monthly household income: $7,600

- Monthly household expenses: $2,600

Using the Manulife One account, we were able to consolidate their existing mortgage and personal loan, totaling $183,000 in debt. The Manulife One account also incorporated their chequing account balance of $4,000, immediately reducing their debt.

Key benefits for this client:

- Debt consolidation: Combined mortgage and personal loan into one account.

- Interest savings: Projected to save $36,689.86 in interest costs.

- Faster debt repayment: Could be debt-free in 3 years, 6 months instead of 13 years, 8 months.

- Simplified banking: All regular banking combined into one easy-to-use account.

The Manulife One account allowed the client to:

- Deposit their income directly into the account, immediately reducing their debt balance

- Access their home equity when needed, up to their borrowing limit

- Enjoy flexibility with sub-accounts for tracking specific debts or locking in portions at fixed rates

- Potentially become debt-free 10 years and 2 months earlier than with their previous financial setup

This case study demonstrates how Mortgage Winners, using the Manulife One product, can help clients consolidate debt, save on interest, and achieve their financial goals more quickly. The all-in-one nature of the account simplifies banking while providing the flexibility to manage various aspects of their finances efficiently.

It’s important to note that results may vary based on individual financial situations, and clients should review their accounts regularly to ensure they’re meeting their goals. For those interested in learning more about how Manulife One could benefit their specific situation, we encourage reaching out to Mortgage Winners for a personalized consultation.

How does the Manulife One approval process work?

The approval process for the Manulife One program is indeed more comprehensive than traditional mortgage approvals. Here’s what potential clients should know:

- Equity consideration: The amount of equity in your home plays a crucial role in the approval process.

- Credit evaluation: Your credit history and score are important factors.

- Debt service ratios: Both Gross Debt Service (GDS) and Total Debt Service (TDS) ratios are carefully considered to ensure affordability.

- Holistic financial assessment: The approval process looks beyond just assets and debts, taking a more complete view of your financial situation.

- Savings utilization: One of the key benefits is the ability to apply savings directly to your outstanding mortgage balance, potentially saving significant amounts in interest costs.

- Account consolidation: The program aims to consolidate various bank accounts into one, streamlining your finances and potentially making them more efficient.

This more stringent approval process ensures that clients who are approved for Manulife One are well-positioned to benefit from its unique features. The goal is to help clients use their money more effectively, potentially becoming debt-free sooner while maintaining financial flexibility.

For those interested in the Manulife One program, we at Mortgage Winners are here to guide you through this comprehensive approval process and help determine if this solution aligns with your financial goals.