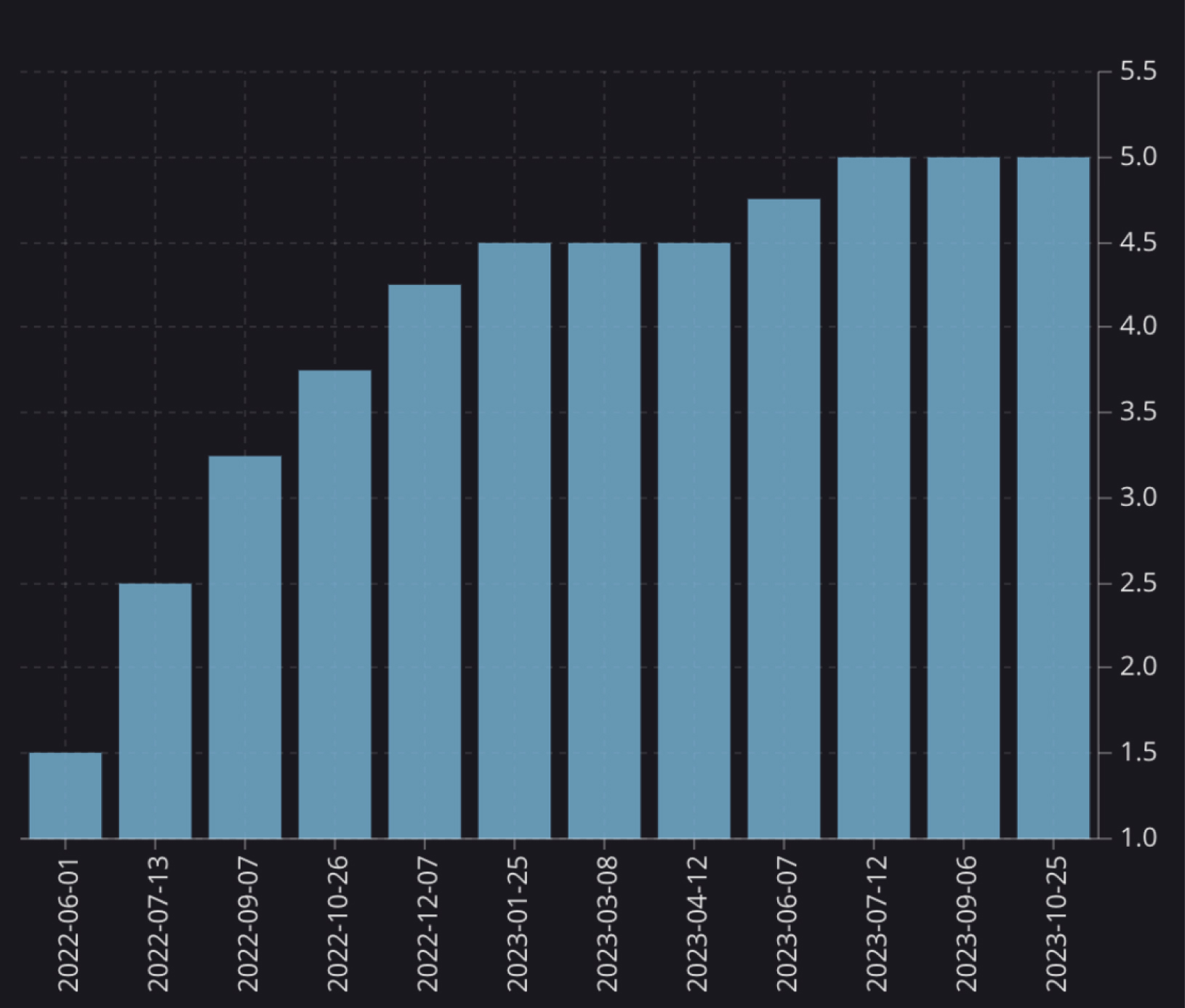

The Bank of Canada kept its key interest rates steady at 5%, maintaining its policy of reducing its balance sheet.

This decision was influenced by the slowing global economy, with growth projections adjusted slightly. In Canada, past interest rate increases have had a cooling effect on the economy, particularly in terms of consumption and business investment. While inflation has been fluctuating, it is expected to gradually ease.

The Bank is closely monitoring various economic indicators, and it is prepared to raise rates further if necessary to achieve price stability. The overall aim remains to restore price stability for Canadians.

The next overnight rate target announcement is on December 6, 2023. The Bank will provide a full economic and inflation outlook, including risks, in the Monetary Policy Report on January 24, 2024.

To explore options to improve your cash flow, click here.