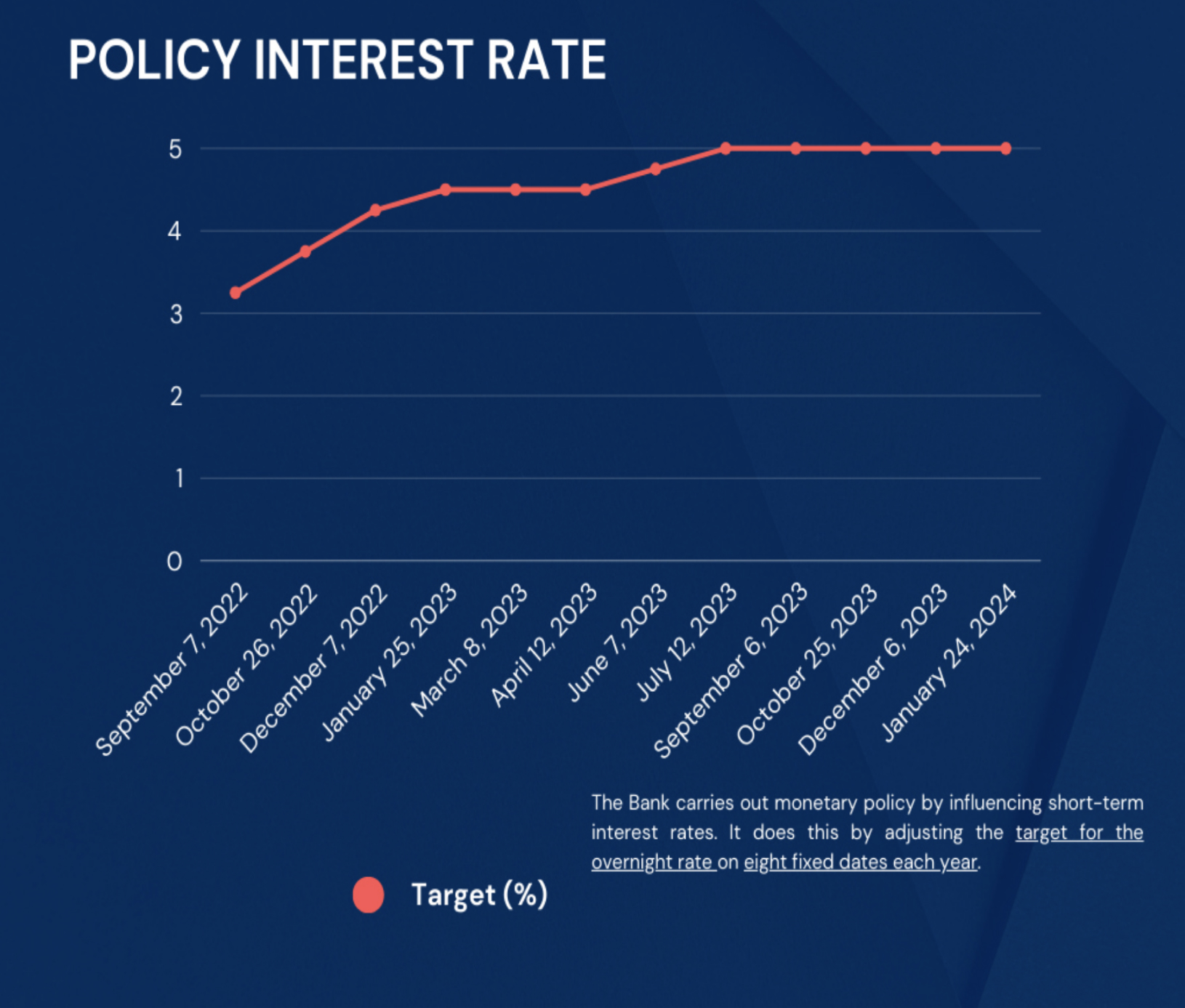

For the first time in a year, Canada’s central bank has opted not to increase the overnight lending rates, maintaining the current interest rate at 4.5%.

Economists broadly anticipated the hold after eight straight rises saw the benchmark rate rise by 425 basis points since March 2nd of last year. With the goal of taming excessive inflation, the central bank embarked on one of the quickest rate tightening cycles in its history.

The annual inflation rate in Canada has fallen from 8.1 percent in mid-2022 to 5.9 percent in January. Shorter-term estimates of core inflation — a gauge the Bank frequently monitors since it excludes more volatile price pressures — are also trending upward.

The Bank of Canada stated in a statement accompanying its rate decision on Wednesday that the latest economic data is consistent with its expectation of inflation returning to roughly 3% by mid-2023. The next report on the Consumer Price Index will be made public on March 21st, 2023 covering February data.

The Bank of Canada will announce its next interest rate decision on April 12.

To explore options to improve your cash flow, click here.