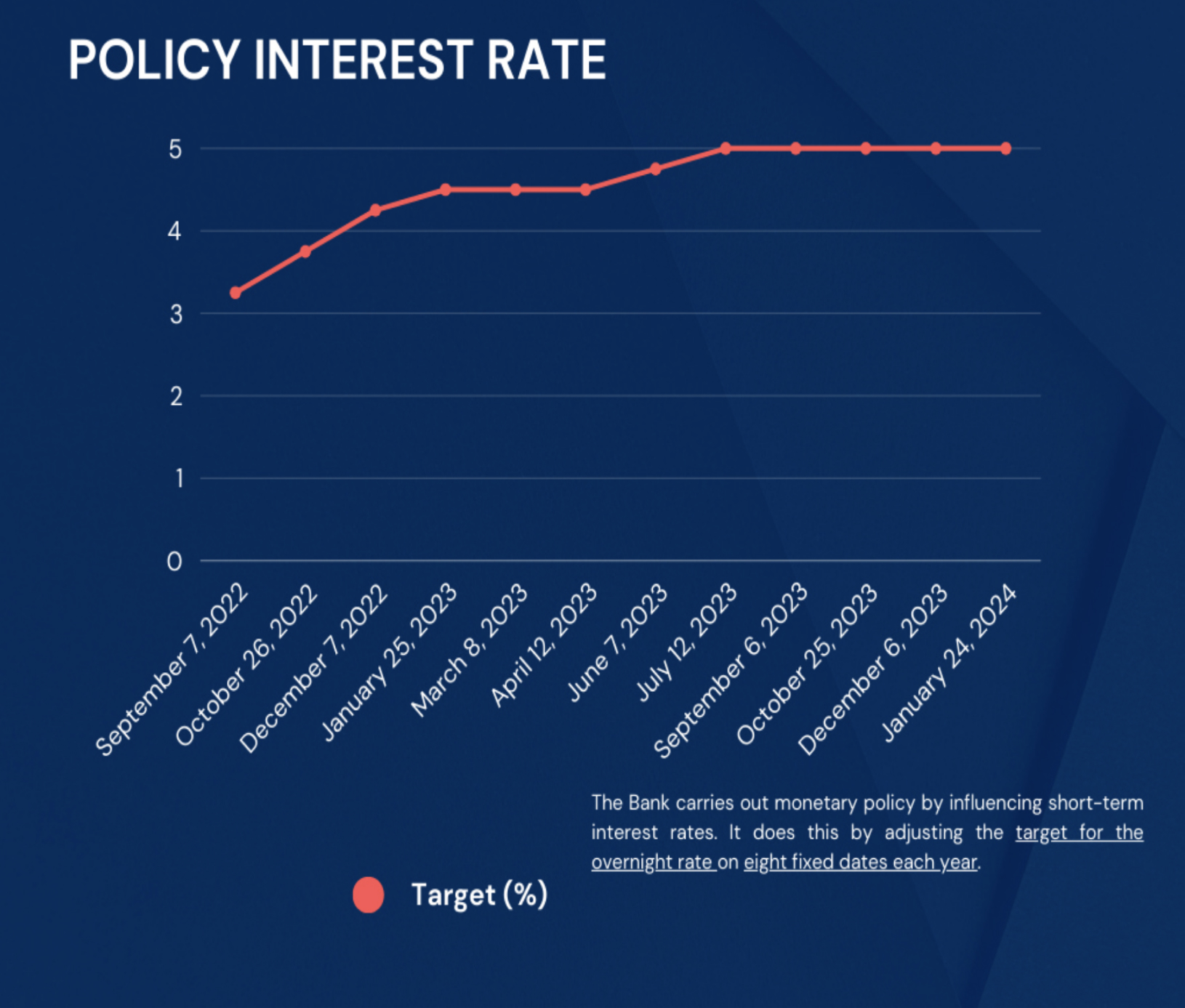

The Bank of Canada raises the key interest rate by 25 basis points.

The Bank of Canada lifted its overnight interest rate by 25 basis points to 4.50%. This is the Bank’s eighth consecutive rate hike and was expected by markets.This is the highest the Bank of Canada’s key rate has been since 2007.

The prime rate rises to 6.7% as a result.

A homeowner with a variable-rate mortgage can expect to pay approximately $28 more per month per $100,000 of mortgage for every 50 basis point increase (0.5%).

Inflation is expected to fall sharply this year. Lower energy costs, improved global supply circumstances, and the effects of higher interest rates on demand are predicted to reduce CPI inflation to roughly 3% in the middle of this year, before returning to the 2% objective in 2024.

The next announcement of the overnight rate goal is set on March 8, 2023. On April 12, 2023, the Bank will publish its next comprehensive prognosis for the economy and inflation, including risks to the projection, in the MPR.

To book a meeting with a Mortgage specialist, click here.